An attorney invoice template is an official document issued by an attorney or secretary for the purpose of collecting payment for billable hours spent providing legal services to a client. The invoice contains both the law office and the client’s contact information and specifies the due date that the full invoice amount is to be paid by. Sending clients an invoice helps with record keeping and improves the likelihood that clients pay on time.

Law firm invoice – a billing form for established businesses that employ one (1) or more lawyers.

Step 1 – Download the invoice in WORD, PDF, or Google Sheets.

Step 2 – To start, begin by deleting the example legal company and enter the applicable company name.

Step 3 – Below the main header, enter the company details. If one of the fields (such as having a fax number) does not apply, leave the field blank.

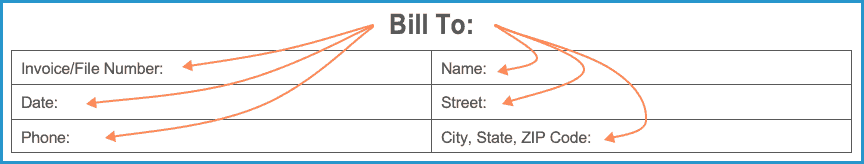

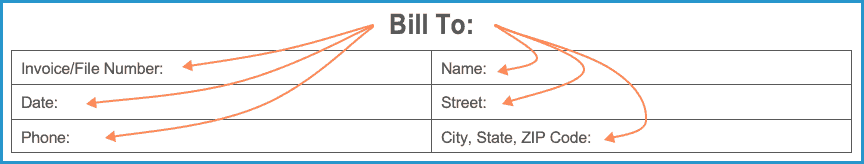

Step 4 – Next, enter the client’s contact information, the date that the client will receive the invoice, and the invoice number (or case number).

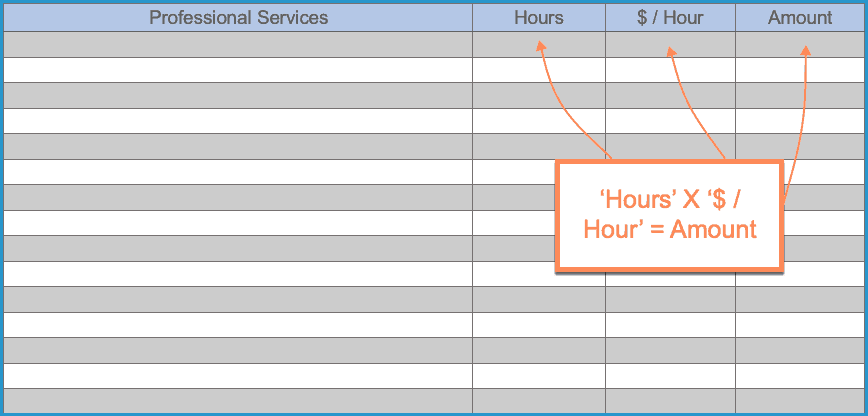

Step 5 – In the “Professional Services” column, enter the various service(s) that the client will be charged for. In the proceeding column, enter the number of hours that were worked during each service, followed by the hourly rate that is charged for each. Multiply the hours worked by the hourly rate and enter the result into the “Amount” column.

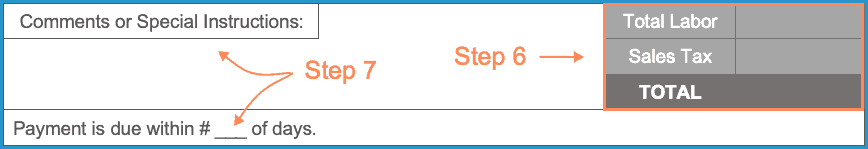

Step 6 – Add the Sales Tax to the Total Labor, and enter the result into the TOTAL cell.

Step 7 – Enter any comments or special requests into the box to the left of the ‘Total Labor” cell, and finally, enter the number of days the client has to pay off the invoice.

Step 1 – Download the invoice in Excel (.xlsx).

Step 2 – Enter the name of the legal company where it says “Legal Company Name Here” followed by the contact information of the law office or attorney.

Step 3 – Beneath the “Bill To” title, enter the client’s contact information. If an invoice number is not used for organization purposes, leave the field blank.

Step 4 – Now, enter the service(s) that were rendered for the client in the “Description” fields followed by the number of hours each service took and the hourly rate ($ / Hour) that is charged for each service. The “Amount” and “Total Labor” columns will calculate automatically.

Step 5 – Add on any sales tax, and the “TOTAL” cell will calculate on its own. Finally, enter any comments for the client. This can include notes about the services that were provided or payment instructions. Finally, enter the number of days the client has to pay for the services in full. The invoice is now ready to be delivered to the client.